It’s a brokerage account that charges no fees and pays 3% on savings and checking.

They are trying to compete with the big mega banks and based on responses I’m seeing, seem to be starting off well.

https://www.robinhood.com/

I’ve “got in line” to sign up. It says I’m 80,000 something in line.

This link is an invite for friends and to move down the list to sign up if anyone is interested. https://share.robinhood.com/cs-haroldp127

From nerd wallet:

Robinhood Review 2018

Arielle O'Shea & Anna-Louise Jackson

Robinhood is a free-trading app that’s ideal for investors who seek the ability to buy a wide selection of stocks, options and ETFs without paying commissions or fees.

But of course, there’s a tradeoff to anything that’s free. Robinhood lacks a full-service online trading platform — though it upped its game for 2018, with the addition of free options trading — and some investors may find the range of available assets to be lacking (no mutual funds, for example).

In December, Robinhood announced plans to expand its offerings to include checking and savings accounts, with a whopping 3% interest on both. There will be no fees associated with these accounts, along with access to a large network of ATMs. This new benefit may be particularly attractive to people who want much of their savings, investing and broader finances under one roof.

5.0 NerdWallet rating

Compare Robinhood to other providers

»Want help managing your investments? Check out our picks for top robo-advisors.

Robinhood is best for:

Where Robinhood shines

Commissions: This is obvious: What’s better than free? Robinhood’s commitment to providing 100% commission-free stock, options and ETF trades is admirable, and the savings for investors who trade frequently is significant. After all, every dollar you save on commissions and fees is a dollar added to your returns. The company has continued to expand its free offerings. It added options trading in December 2017, and in June 2018 added multi-leg options, permitting traders to use less capital in setting up these complex trades.

» New to investing? Learn more about how to buy stocks.

Account minimum: Robinhood doesn’t have one, which means investors can get started right away. Of course, in order to invest, you’ll need enough to purchase at least one share of the stock or ETF you have your eye on. But this is a low bar of entry in a sea of online brokers that often require $1,000 or more to open an account.

One note: Like other brokers, Robinhood requires a $2,000 minimum portfolio balance to open a margin account. This is a Financial Industry Regulatory Authority regulation.

Following 2017’s unprecedented gains in bitcoin, Robinhood makes a big splash this year with the introduction of cryptocurrency trading. To do so, you’ll need an account with Robinhood Crypto, which isn’t a broker-dealer. The minimum amount required for orders is $0.10 for bitcoin and $0.01 for ethereum.

Ease of use: If you’re accustomed to using a smartphone — and Robinhood’s target user base obviously is — you’ll find the sign-up and account funding process quick and painless. It all happens within the app in a matter of minutes, with just a few quick questions that gather your personal information, contact details, Social Security number and means of funding your account. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers.

The company uses instant verification with many major banks, sparing users the hassle of reporting micro-deposits to an account to verify information. Bank transfers take four to five trading days to complete and can be set up to occur automatically on a weekly, biweekly, monthly or quarterly schedule.

New customer bank transfers of up to $1,000 are available instantly for investing. Robinhood Instant, a free account upgrade, also makes the proceeds from the sale of stocks or ETFs available immediately to reinvest. Accounts with Robinhood Instant are subject to margin trading regulations.

Streamlined interface: This could be a negative, as the service doesn’t offer all the bells and whistles of a typical online stock broker. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades, and the app supports market orders, limit orders, stop limit or

ders and stop orders. The web version, which currently has a waiting list, will feature collections of stocks (like those with female CEOs), analyst ratings, earnings, news, research and tools to discover new stocks.

ders and stop orders. The web version, which currently has a waiting list, will feature collections of stocks (like those with female CEOs), analyst ratings, earnings, news, research and tools to discover new stocks.

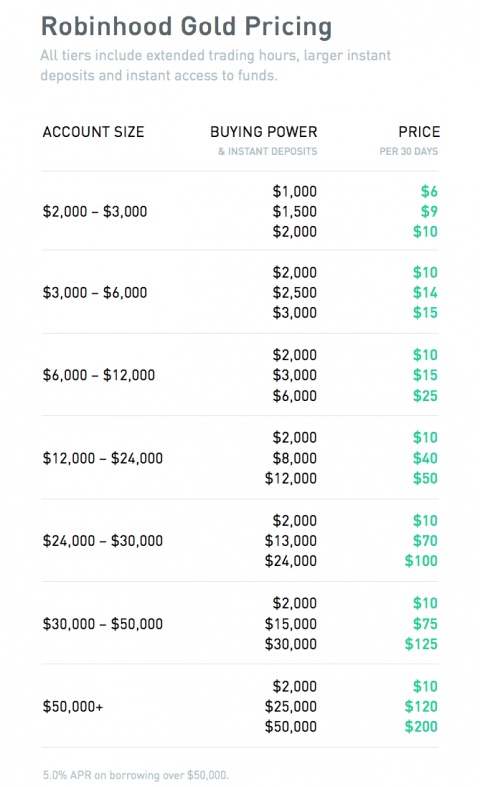

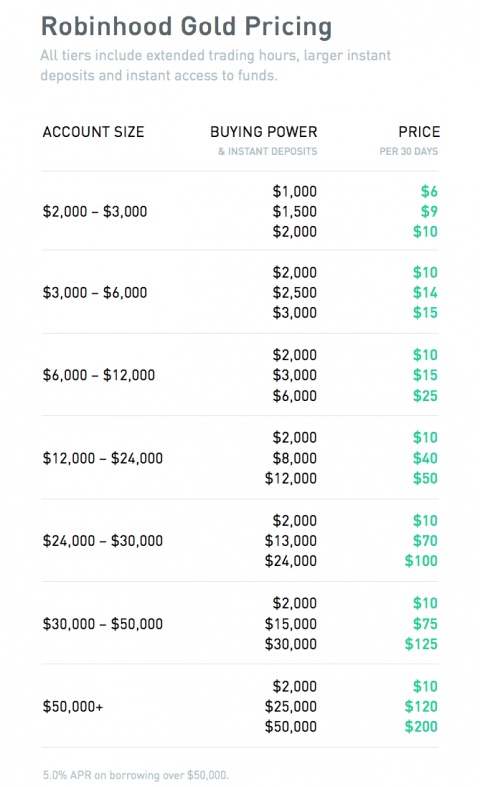

Robinhood Gold:

Robinhood Gold is a premium service that offers investors access to extended-hours trading — 9 a.m. to 6 p.m. Eastern — and the ability to trade on margin, also known as borrowed money. The opt-in service requires a minimum balance of $2,000, the regulatory requirement for a margin account. It also carries a flat monthly fee based on margin – or “buying power,” as Robinhood calls it — and account size.

New investors should be aware that margin trading is risky. You’re trading on dollars borrowed from the broker, which means you can lose more than you invest. (Here’s more on how margin trading works.)

Where Robinhood falls short

Limited securities: Previously Robinhood supported only stock and ETF trading, but the firm expanded its offerings to options and cryptocurrencies (like bitcoin) in 2018. Still, mutual funds and bonds aren’t supported. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. The company has said it hopes to offer this feature in the future.

One account option: Robinhood supports only individual taxable accounts (often called brokerage accounts; you can learn more about these accounts here). For most investors, investing through a taxable brokerage account should come only after they have invested 10% to 15% of their income for retirement in a tax-advantaged account like a 401(k) or IRA.

» Looking for a retirement account instead?: See our roundup of best IRA account providers.

Tools and resources still lacking:Robinhood has made strides to increase the tools and research for its customers, but the offerings still pale in comparison to other brokers, like Merrill Edge and Fidelity. It lacks the robust research reports or analysis software of other brokers and doesn’t offer much in the way of educational resources, despite the fact that it caters largely to young, new investors. You can, however, create watch lists, and access real-time data. Robinhood for Web will reportedly offer more research and discovery tools, however, like a list of stocks other investors bought or the average price other Robinhood investors paid.

Is Robinhood right for you?

These days, “free” often just means the extra fees are buried deep where you can’t find them, at least not until they show up as a surprise addition to your account statement. Robinhood is refreshing because the service is truly free: You can trade without spending a dime in fees or commissions, and there are no hidden costs here.

You’ll give up a few things in exchange — trading tools, research, education, the full range of investment options — but if limiting costs is your No. 1 concern, Robinhood is a solid choice.

Interested in other brokers that work well for new investors? Also see NerdWallet’s rankings of the best brokers for beginners.

They are trying to compete with the big mega banks and based on responses I’m seeing, seem to be starting off well.

https://www.robinhood.com/

I’ve “got in line” to sign up. It says I’m 80,000 something in line.

This link is an invite for friends and to move down the list to sign up if anyone is interested. https://share.robinhood.com/cs-haroldp127

From nerd wallet:

Robinhood Review 2018

Arielle O'Shea & Anna-Louise Jackson

Robinhood is a free-trading app that’s ideal for investors who seek the ability to buy a wide selection of stocks, options and ETFs without paying commissions or fees.

But of course, there’s a tradeoff to anything that’s free. Robinhood lacks a full-service online trading platform — though it upped its game for 2018, with the addition of free options trading — and some investors may find the range of available assets to be lacking (no mutual funds, for example).

In December, Robinhood announced plans to expand its offerings to include checking and savings accounts, with a whopping 3% interest on both. There will be no fees associated with these accounts, along with access to a large network of ATMs. This new benefit may be particularly attractive to people who want much of their savings, investing and broader finances under one roof.

5.0 NerdWallet rating

Compare Robinhood to other providers

»Want help managing your investments? Check out our picks for top robo-advisors.

Robinhood is best for:

- Frequent stock, options or ETF traders

- Mobile users

- Individual taxable accounts

- Margin accounts

Where Robinhood shines

Commissions: This is obvious: What’s better than free? Robinhood’s commitment to providing 100% commission-free stock, options and ETF trades is admirable, and the savings for investors who trade frequently is significant. After all, every dollar you save on commissions and fees is a dollar added to your returns. The company has continued to expand its free offerings. It added options trading in December 2017, and in June 2018 added multi-leg options, permitting traders to use less capital in setting up these complex trades.

» New to investing? Learn more about how to buy stocks.

Account minimum: Robinhood doesn’t have one, which means investors can get started right away. Of course, in order to invest, you’ll need enough to purchase at least one share of the stock or ETF you have your eye on. But this is a low bar of entry in a sea of online brokers that often require $1,000 or more to open an account.

One note: Like other brokers, Robinhood requires a $2,000 minimum portfolio balance to open a margin account. This is a Financial Industry Regulatory Authority regulation.

Following 2017’s unprecedented gains in bitcoin, Robinhood makes a big splash this year with the introduction of cryptocurrency trading. To do so, you’ll need an account with Robinhood Crypto, which isn’t a broker-dealer. The minimum amount required for orders is $0.10 for bitcoin and $0.01 for ethereum.

Ease of use: If you’re accustomed to using a smartphone — and Robinhood’s target user base obviously is — you’ll find the sign-up and account funding process quick and painless. It all happens within the app in a matter of minutes, with just a few quick questions that gather your personal information, contact details, Social Security number and means of funding your account. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers.

The company uses instant verification with many major banks, sparing users the hassle of reporting micro-deposits to an account to verify information. Bank transfers take four to five trading days to complete and can be set up to occur automatically on a weekly, biweekly, monthly or quarterly schedule.

New customer bank transfers of up to $1,000 are available instantly for investing. Robinhood Instant, a free account upgrade, also makes the proceeds from the sale of stocks or ETFs available immediately to reinvest. Accounts with Robinhood Instant are subject to margin trading regulations.

Streamlined interface: This could be a negative, as the service doesn’t offer all the bells and whistles of a typical online stock broker. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades, and the app supports market orders, limit orders, stop limit or

Robinhood Gold:

Robinhood Gold is a premium service that offers investors access to extended-hours trading — 9 a.m. to 6 p.m. Eastern — and the ability to trade on margin, also known as borrowed money. The opt-in service requires a minimum balance of $2,000, the regulatory requirement for a margin account. It also carries a flat monthly fee based on margin – or “buying power,” as Robinhood calls it — and account size.

New investors should be aware that margin trading is risky. You’re trading on dollars borrowed from the broker, which means you can lose more than you invest. (Here’s more on how margin trading works.)

Where Robinhood falls short

Limited securities: Previously Robinhood supported only stock and ETF trading, but the firm expanded its offerings to options and cryptocurrencies (like bitcoin) in 2018. Still, mutual funds and bonds aren’t supported. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. The company has said it hopes to offer this feature in the future.

One account option: Robinhood supports only individual taxable accounts (often called brokerage accounts; you can learn more about these accounts here). For most investors, investing through a taxable brokerage account should come only after they have invested 10% to 15% of their income for retirement in a tax-advantaged account like a 401(k) or IRA.

» Looking for a retirement account instead?: See our roundup of best IRA account providers.

Tools and resources still lacking:Robinhood has made strides to increase the tools and research for its customers, but the offerings still pale in comparison to other brokers, like Merrill Edge and Fidelity. It lacks the robust research reports or analysis software of other brokers and doesn’t offer much in the way of educational resources, despite the fact that it caters largely to young, new investors. You can, however, create watch lists, and access real-time data. Robinhood for Web will reportedly offer more research and discovery tools, however, like a list of stocks other investors bought or the average price other Robinhood investors paid.

Is Robinhood right for you?

These days, “free” often just means the extra fees are buried deep where you can’t find them, at least not until they show up as a surprise addition to your account statement. Robinhood is refreshing because the service is truly free: You can trade without spending a dime in fees or commissions, and there are no hidden costs here.

You’ll give up a few things in exchange — trading tools, research, education, the full range of investment options — but if limiting costs is your No. 1 concern, Robinhood is a solid choice.

Interested in other brokers that work well for new investors? Also see NerdWallet’s rankings of the best brokers for beginners.