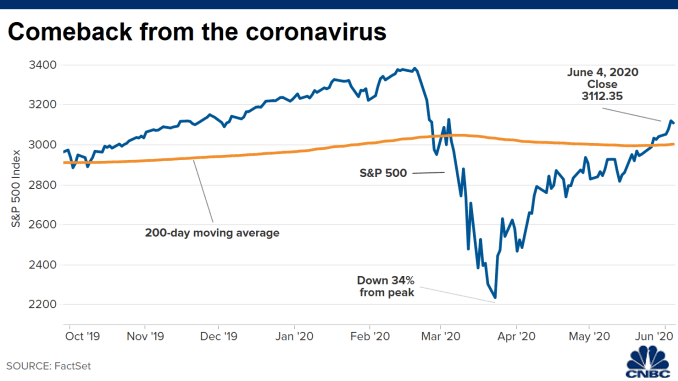

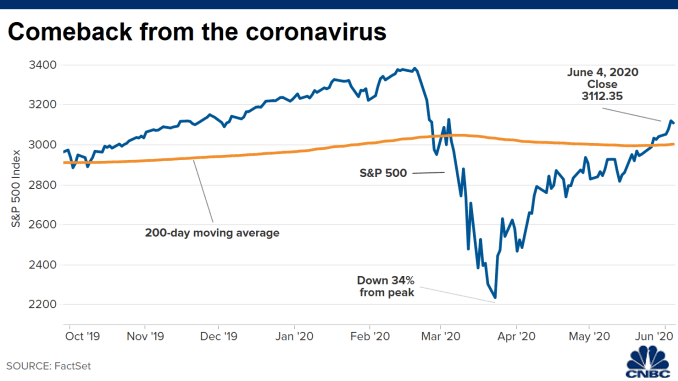

What a roller coaster ride. I’m starting to get nauseous.

As of 6:44 a.m. ET, Dow Jones Industrial Average futures were up about 700 points, implying a gain of more than 600 points at the open on Friday. S&P 500 futures were up about 3%.

Nasdaq-100 futures jumped nearly 5% and were ‘limit up,’ meaning no trades could take place above those levels. CME Group halts futures at certain bands in overnight trading in order to curb panic trading. Futures have hit these extreme levels multiple times during this volatile month, mostly to the downside.

A number of factors contributed to the positive sentiment:

The gains are a break from the extreme volatility of late in the market, as investors try to make sense of the ongoing coronavirus-induced business slowdown.

On Wednesday, the Dow dropped 1,338.46 points, or 6.3%, to close below 20,000 for the first time since February 2017. Investors are hoping that was the bottom and that the stock market can recover as the virus cases peak in coming months and government stimulus kicks in.

Still, Thursday’s gains have barely put a dent in what’s been a week of steep losses. The Dow is down 13.36% on the week, putting it on track for its largest weekly percentage loss since the financial crisis. The 30-stock index remains 32% below its all-time high level from February, while the S&P 500 is 29% below its high.

The Fed has announced a number of stimulus measures, but it hasn’t assuaged investors’ fears.

“Market volatility will persist until the government – fiscal or monetary – provides a backstop to stressed corporates and small & medium businesses,” New York Life Investments’ Lauren Goodwin said Thursday. “Support of those functions is vital to ensuring the economic disruption of covid-19, though severe, is temporary,” she added.

Late Thursday, California Gov. Gavin Newson announced the statewide order.

“Home isolation is not my preferred choice ... but it is a necessary one ...This is not a permanent state, this is a moment in time,” Newsom said.

As the number of coronavirus cases continues to rise, Bridgewater’s Ray Dalio was the latest investor to weigh in on the long-term impacts of the virus.

“What’s happening has not happened in our lifetime before ... What we have is a crisis,” the Bridgewater founder said Thursday on CNBC’s “Squawk Box.”“There will also be individuals who have very big losses. ... There’s a need for the government to spend more money, a lot more money.”

He said the outbreak will cost U.S. corporations up to $4 trillion, and “a lot of people are going to be broke.”

As of 6:44 a.m. ET, Dow Jones Industrial Average futures were up about 700 points, implying a gain of more than 600 points at the open on Friday. S&P 500 futures were up about 3%.

Nasdaq-100 futures jumped nearly 5% and were ‘limit up,’ meaning no trades could take place above those levels. CME Group halts futures at certain bands in overnight trading in order to curb panic trading. Futures have hit these extreme levels multiple times during this volatile month, mostly to the downside.

A number of factors contributed to the positive sentiment:

- California issued a statewide order to ‘stay at home’ for its residents, the kind of drastic measures investors have been hoping for to slow the spread of the virus and reduce the long-term economic damage.

- Oil’s rebound continued. The collapse in crude has raised concerns about a deep global recession. Crude futures were up another 7% after posting their biggest gain ever on Thursday.

- The U.S. dollar declined after central bank actions. A global rush into the greenback for safety and liquidity has sent the currency soaring, but at the same time it’s given another hit to big U.S. exporters by raising costs at this difficult time.

- Tech shares are bouncing as investors bet the sector can weather a recession. Shares of Microsoft were up more than 6% in premarket trading.

The gains are a break from the extreme volatility of late in the market, as investors try to make sense of the ongoing coronavirus-induced business slowdown.

On Wednesday, the Dow dropped 1,338.46 points, or 6.3%, to close below 20,000 for the first time since February 2017. Investors are hoping that was the bottom and that the stock market can recover as the virus cases peak in coming months and government stimulus kicks in.

Still, Thursday’s gains have barely put a dent in what’s been a week of steep losses. The Dow is down 13.36% on the week, putting it on track for its largest weekly percentage loss since the financial crisis. The 30-stock index remains 32% below its all-time high level from February, while the S&P 500 is 29% below its high.

The Fed has announced a number of stimulus measures, but it hasn’t assuaged investors’ fears.

“Market volatility will persist until the government – fiscal or monetary – provides a backstop to stressed corporates and small & medium businesses,” New York Life Investments’ Lauren Goodwin said Thursday. “Support of those functions is vital to ensuring the economic disruption of covid-19, though severe, is temporary,” she added.

Late Thursday, California Gov. Gavin Newson announced the statewide order.

“Home isolation is not my preferred choice ... but it is a necessary one ...This is not a permanent state, this is a moment in time,” Newsom said.

As the number of coronavirus cases continues to rise, Bridgewater’s Ray Dalio was the latest investor to weigh in on the long-term impacts of the virus.

“What’s happening has not happened in our lifetime before ... What we have is a crisis,” the Bridgewater founder said Thursday on CNBC’s “Squawk Box.”“There will also be individuals who have very big losses. ... There’s a need for the government to spend more money, a lot more money.”

He said the outbreak will cost U.S. corporations up to $4 trillion, and “a lot of people are going to be broke.”