So my Dad set up an LLC for us back in 2012 and used the LLC to handle the transfer of a Sig- 516 10.5" AR (SBR). We've owned the rifle for years with no issues, Dad has always kept the LLC up to date with the State of Oklahoma.

Well my Dad passed away back in June, since I was listed on the LLC he had already brought the SBR to me to put in my safe not knowing what the future held in store for him due to his health back in December.

Since my Dad's passing I have updated the LLC to have me as the agent in charge, my atty has updated the board members that eliminated my Dad and step family and only has it as my wife and I going forward. The SBR has a copy of the 4473 w/ the tax stamp in the stock with the rifle at all times.

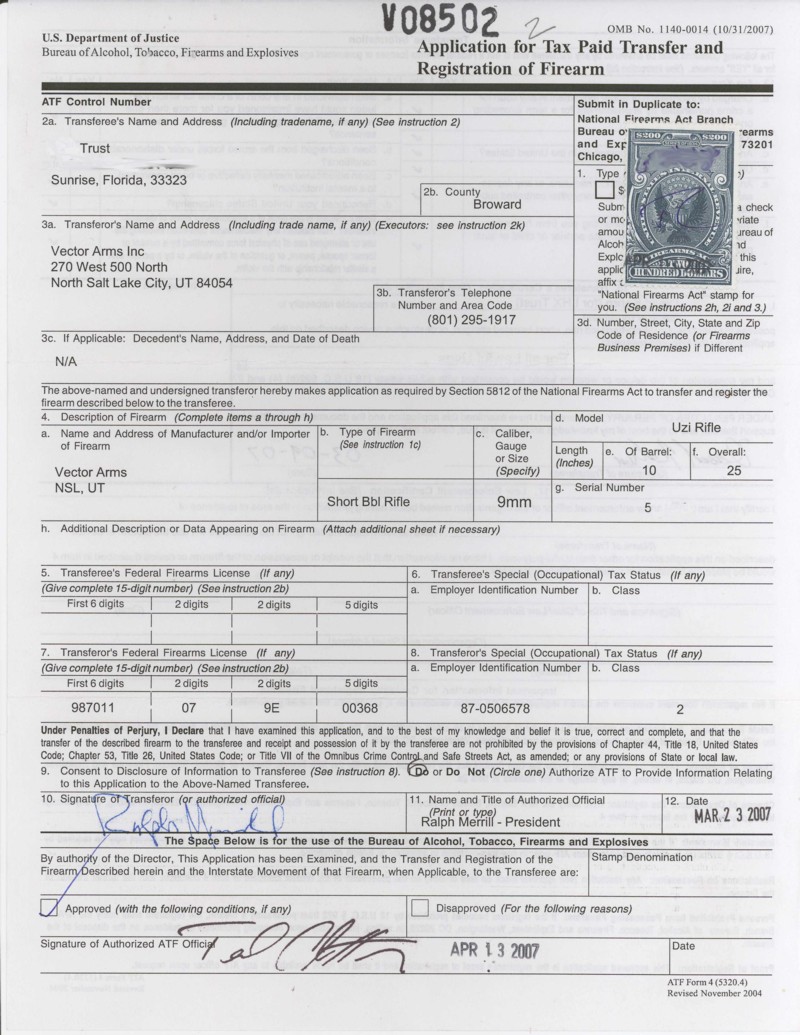

So here is in my question. When you own and posses a NFA item, is there paperwork the owner (my dad) had that has the official tax stamp on it? I thought the 4473 stayed with transferring dealer.

Other than the changes I have already made, what other paperwork do I need to find or get to insure I have no issues owning, using or possessing this rifle going forward?

Thanks in advance... Todd

Well my Dad passed away back in June, since I was listed on the LLC he had already brought the SBR to me to put in my safe not knowing what the future held in store for him due to his health back in December.

Since my Dad's passing I have updated the LLC to have me as the agent in charge, my atty has updated the board members that eliminated my Dad and step family and only has it as my wife and I going forward. The SBR has a copy of the 4473 w/ the tax stamp in the stock with the rifle at all times.

So here is in my question. When you own and posses a NFA item, is there paperwork the owner (my dad) had that has the official tax stamp on it? I thought the 4473 stayed with transferring dealer.

Other than the changes I have already made, what other paperwork do I need to find or get to insure I have no issues owning, using or possessing this rifle going forward?

Thanks in advance... Todd