I had not heard of this SQ until recently.

According to Channel 6 in Tulsa:

"Voters will decide a state question in November that allows for public infrastructure tax districts in Oklahoma. Those districts would essentially be able to issue bonds to pay for various projects if they pass a vote.

Lawmakers are split on whether the districts are a good thing.

Supporters of State Question 833 said it would lead to more housing and development in Oklahoma, while opponents think it gives too much power to only a few people.

State Question 833 adds a new section to Oklahoma's constitution, allowing the creation of public infrastructure districts.

'The basic idea is to provide additional money for improvements to an area to make it more commercially viable,' said State Representative Andy Fugate, D-Del City.

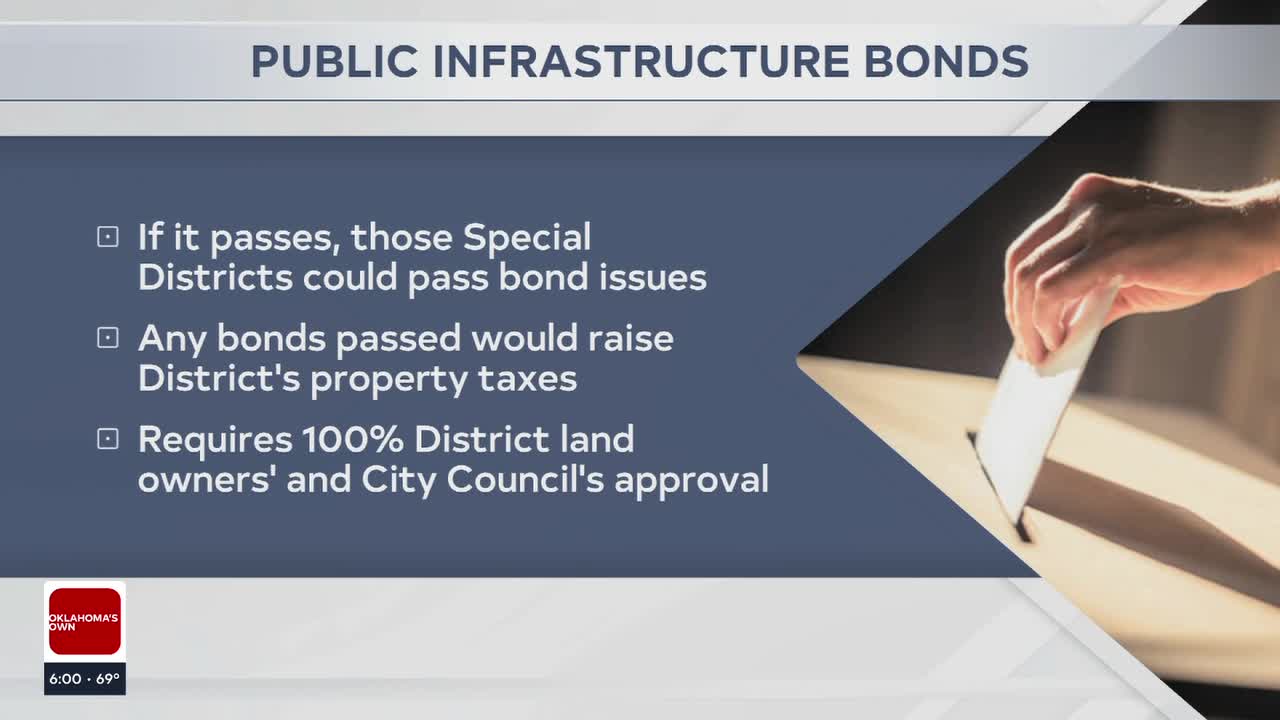

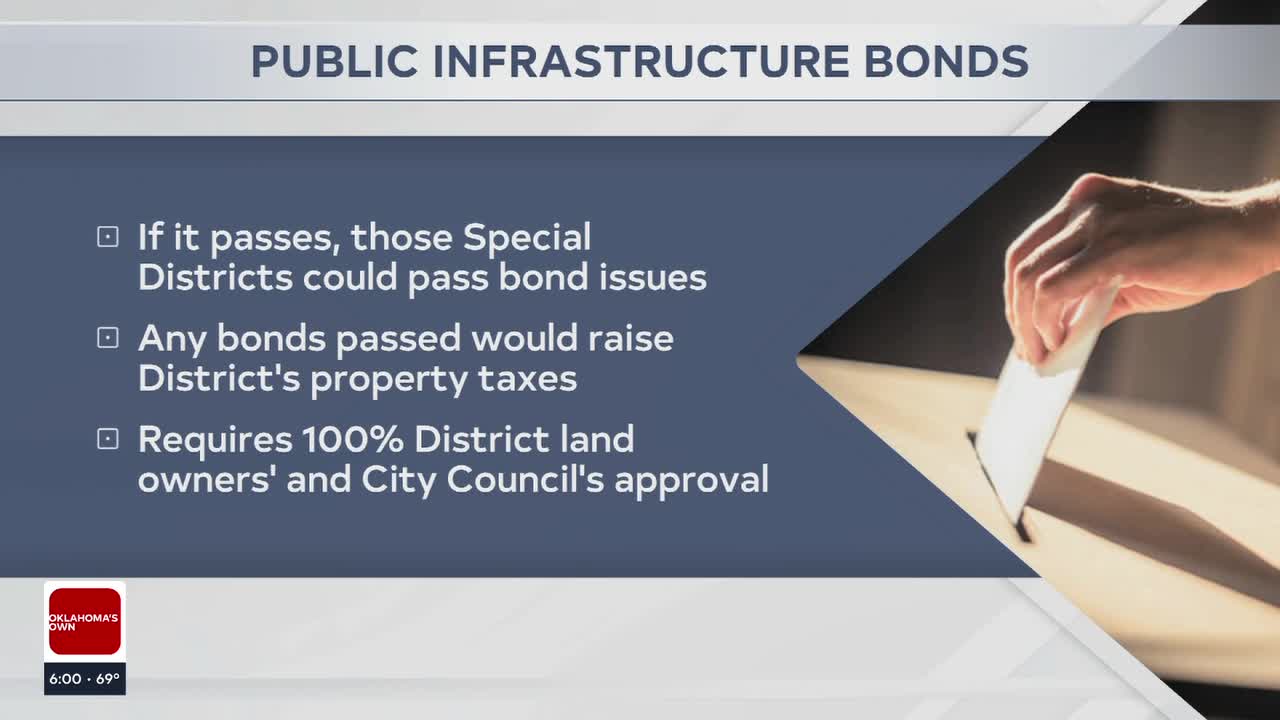

If it passes, those special districts could pass bond issues up to $10 million to pay for things like sewage, roads, sidewalks, and projects like pools or even golf courses. Any bonds passed would raise property taxes for people living in the district.

To create the district, 100 percent of landowners within the area would have to agree and obtain city council approval. The district would be controlled by a board of trustees.

'If you aren't within that PID, you aren't being assessed; only those getting the benefit of the amenities could pay for this,' said State Senator John Haste, R- Broken Arrow."

www.newson6.com

www.newson6.com

According to Channel 6 in Tulsa:

"Voters will decide a state question in November that allows for public infrastructure tax districts in Oklahoma. Those districts would essentially be able to issue bonds to pay for various projects if they pass a vote.

Lawmakers are split on whether the districts are a good thing.

Supporters of State Question 833 said it would lead to more housing and development in Oklahoma, while opponents think it gives too much power to only a few people.

State Question 833 adds a new section to Oklahoma's constitution, allowing the creation of public infrastructure districts.

'The basic idea is to provide additional money for improvements to an area to make it more commercially viable,' said State Representative Andy Fugate, D-Del City.

If it passes, those special districts could pass bond issues up to $10 million to pay for things like sewage, roads, sidewalks, and projects like pools or even golf courses. Any bonds passed would raise property taxes for people living in the district.

To create the district, 100 percent of landowners within the area would have to agree and obtain city council approval. The district would be controlled by a board of trustees.

'If you aren't within that PID, you aren't being assessed; only those getting the benefit of the amenities could pay for this,' said State Senator John Haste, R- Broken Arrow."

What Is Oklahoma State Question 833?

Voters will decide a state question in November that allows for public infrastructure tax districts in Oklahoma. Those districts would essentially be able to issue bonds to pay for different projects if they pass a vote; lawmakers are split on whether the districts are a good thing.