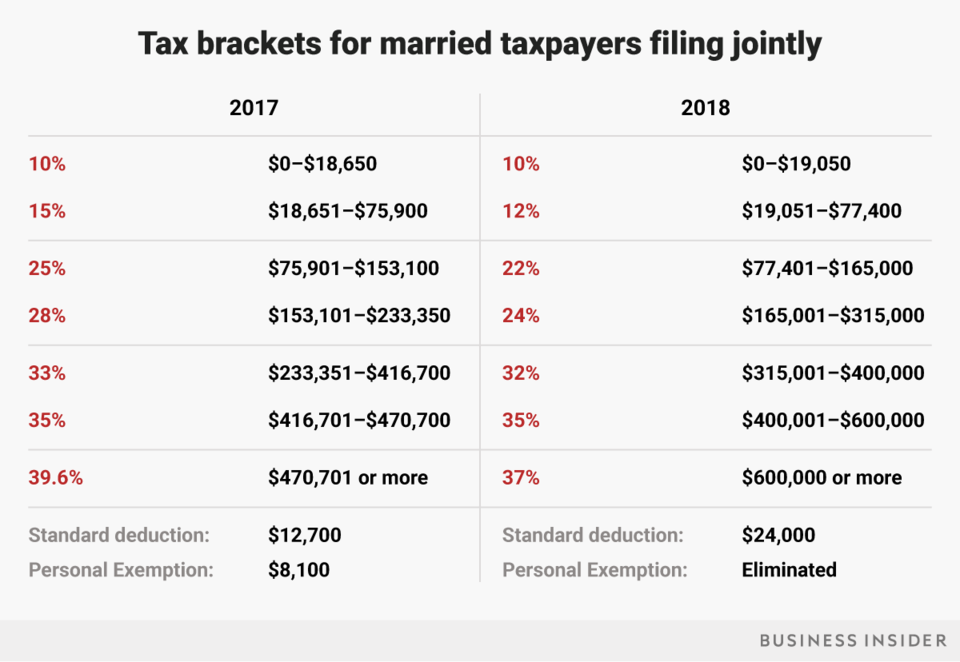

Just curious how many of you are benefiting from the new tax rates. The first check with the new rates show my federal tax dropped 20.5%. This is the difference of what I paid in federal tax last paycheck and what I paid this paycheck divided by the last paycheck federal tax amount.

For me, this is equivalent to about a 5% pay raise. Thank you President Trump!

For me, this is equivalent to about a 5% pay raise. Thank you President Trump!